On May 1, 2004, Hungary joined the European Union along with nine other countries. This article is part of a series exploring how Hungary’s position has changed over 20 years of EU membership, focusing specifically on labor costs.

Labor costs impact competitiveness at both corporate and national levels. Businesses aim to keep labor costs low, while states strive to create an attractive economic environment for companies, often by offering low labor costs to attract investors. But what determines labor costs?

Labor costs encompass wages, benefits, taxes, and contributions, all influenced by regulatory factors like the minimum wage. Additionally, supply and demand dynamics, such as labor shortages and unemployment, play a significant role. Productivity changes are also crucial; as the workforce becomes more educated and productive, performing higher value-added work, companies are willing to pay higher wages.

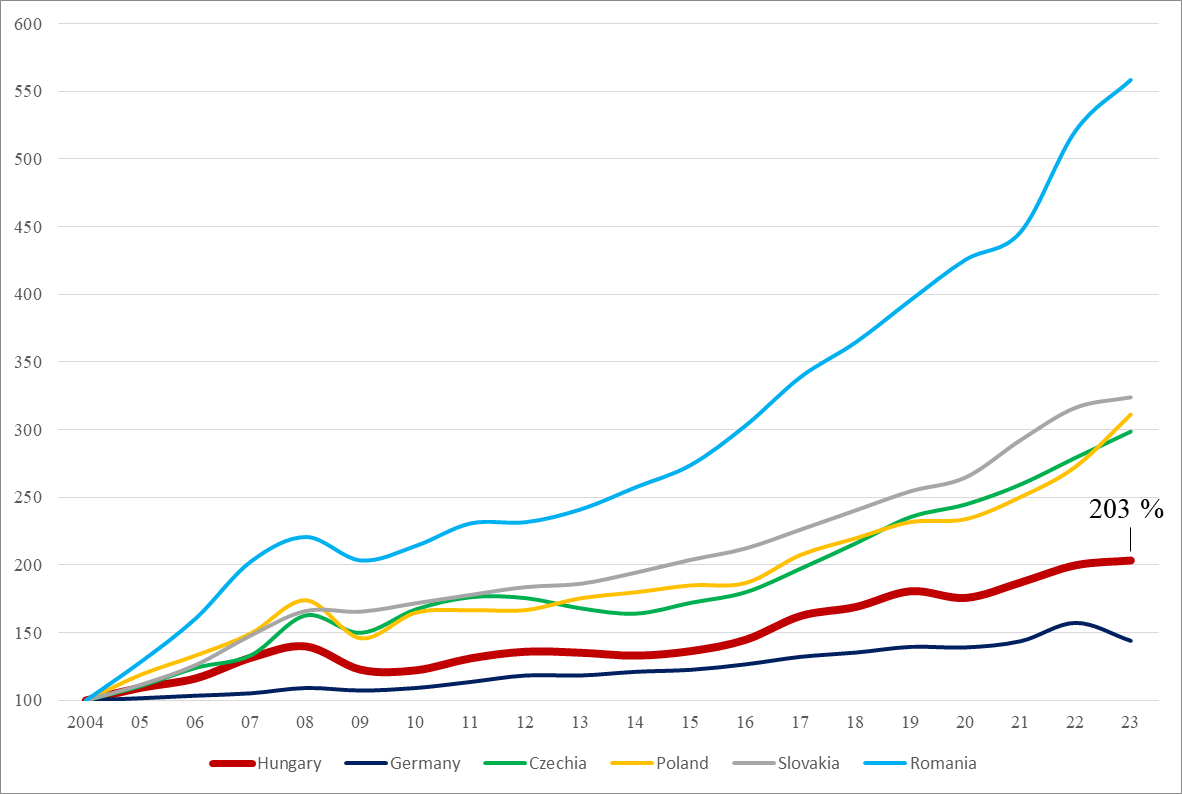

Changes in Labor Costs Calculated in Euros (2004=100%)

Source: GKI calculations based on Eurostat data (2023)

Since 2004, labor costs in Hungary calculated in euros have doubled and tripled in forints. During this period, German labor costs increased by 44%, aligning with euro inflation. In developed economies, wage levels—and thus labor costs—naturally grow at a slower pace than in countries starting from a lower base. Therefore, it is useful to compare these expenses with those in other regional countries.

In Poland, Slovakia, and the Czech Republic, labor costs measured in euros have more than tripled over two decades. For foreign multinational companies, this made Hungary an attractive investment destination, as their costs increased less here than elsewhere, enabling higher profits. Romania’s situation is unique: labor costs in euros have increased 5.5 times, due to starting from a low base and rapid economic development. Additionally, the whitening of the economy (as seen with Hungary’s introduction of online cash registers) also contributed to this increase.

Why have Hungary’s labor costs increased less? The primary goal of Hungarian economic policy has been to attract foreign direct investment. To achieve this, the government keeps labor taxes (personal income tax, social contribution tax, etc.) low while maintaining high consumption taxes (VAT, excise tax, consumption tax, etc.).

Another significant policy tool has been the devaluation of the forint. As the forint’s value decreases against the euro, forint-based payments cost multinational companies fewer euros. While imported goods become more expensive domestically, this does not affect export-focused multinationals. However, this currency devaluation does not benefit most Hungarian employers, whose revenues are typically in forints, but their imports are realised in foreign currencies.

In summary, Hungary’s labor costs have increased much less in euros since EU accession compared to neighboring countries, theoretically providing a competitive advantage. However, the low productivity growth rate means that many businesses attracted to Hungary engage in low value-added production. The forint’s devaluation, forced minimum wage increases, generous subsidies, and reduced labor costs for machinery and automotive multinationals have all contributed to Hungary’s lagging competitiveness improvement compared to regional countries.

Download full analysis